How Much Is The Maximum 401k Contribution 2024. The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. 2023 contribution limits for 2023, you can contribute up to $22,500.

Contribution limits for a roth 401(k) are the same as a traditional 401(k). The secure 2.0 act plans to adjust retirement savings plans and contribution.

The Ira Catch‑Up Contribution Limit For Individuals Aged 50.

The irs changed the yearly 401(k) contribution limits (also known as elective deferral limits) for 2023 and 2024.

In 2024, 401 (K)S Max Out At $23,000 For Savers Under 50 And $30,500 For Those 50 And Over.

In 2024, the maximum contribution to traditional or roth iras is $7,000,.

If You're Age 50 Or.

This amount is up modestly from 2023, when the individual 401.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401k Contribution Limit Financial Samurai, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. The irs increased 2024 contribution limits for 401(k)s, 403(b)s, and iras.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, For 2024, the contribution limit increases again to $23,000. Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2024 has increased to $23,000, up.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, 401 (k) contribution limits for 2024. For those 50 and older, the total contribution limit will be $75,500.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, In 2024, the maximum contribution to traditional or roth iras is $7,000,. In 2024, 401 (k)s max out at $23,000 for savers under 50 and $30,500 for those 50 and over.

Source: www.jackiebeck.com

Source: www.jackiebeck.com

401(k) Contribution Limits for 2024, 2023, and Prior Years, Retirement savers are eligible to put $500 more in a 401(k) plan in 2024: The secure 2.0 act plans to adjust retirement savings plans and contribution.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, 2023 contribution limits for 2023, you can contribute up to $22,500. The ira catch‑up contribution limit for individuals aged 50.

Source: www.medben.com

Source: www.medben.com

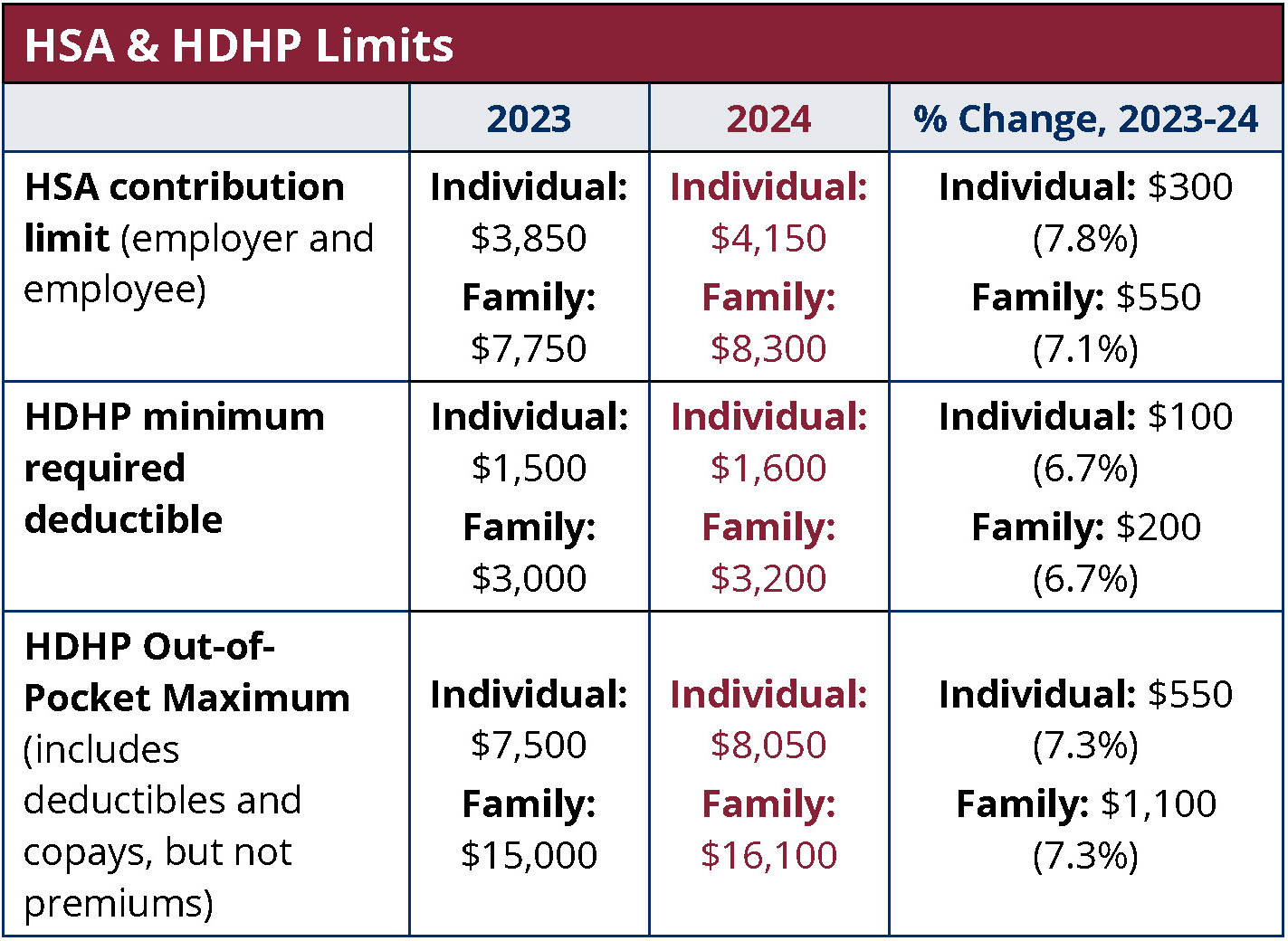

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, The secure 2.0 act plans to adjust retirement savings plans and contribution. The limit on employee elective deferrals to a simple 401 (k) plan is:

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum 401(k) Contribution for 2022, Employees can invest more money into 401 (k) plans in 2024, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2024. This increase reflects a continued trend.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at. In 2024, the total contribution limit per employer will increase to $68,000 for individuals under 50.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, In 2024, the total contribution limit per employer will increase to $68,000 for individuals under 50. The secure 2.0 act plans to adjust retirement savings plans and contribution.

The Irs Increased 2024 Contribution Limits For 401(K)S, 403(B)S, And Iras.

Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up.

For 2024, The 401(K) Annual Contribution Limit Is $23,000, Up From $22,500 In 2023.

The ira catch‑up contribution limit for individuals aged 50.

401 (K) Limit Increases To $23,000 For 2024, Ira Limit Rises To $7,000.

What is the maximum 401(k) contribution for 2024 for over 50?

Category: 2024